Specialty Pharmaceutical Market Set to Surge to US$ 1532.8 Billion by 2033

The Specialty Pharmaceutical Market size is expected to be worth around USD 1532.8 billion by 2033, from USD 68.3 billion in 2023

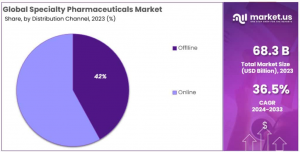

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The Specialty Pharmaceutical Market Size is projected to grow from USD 68.3 billion in 2023 to USD 1532.8 billion by 2033, marking a compound annual growth rate (CAGR) of 36.5%. This rapid growth is propelled by the expansion of specialty drugs in fields such as oncology and immunology. With over 40% of drugs currently under development classified as specialty drugs, the sector benefits from substantial investment in research and development. These medications, often designed for complex conditions, necessitate specialized handling and administration, adding to their high cost and economic impact on healthcare systems.

Specialty pharmaceuticals, despite representing a minor fraction of total prescriptions, account for a significant portion of pharmacy spending. This financial significance is driving healthcare systems to integrate specialty pharmacies, aiming to enhance medication management and patient outcomes. Such integration facilitates improved access to patient records and coordinated care, which are vital for the effective administration of treatment regimens and monitoring of patient health.

However, the specialty pharmaceutical sector faces considerable challenges, particularly in distribution and access within payer networks. Many healthcare providers encounter hurdles due to insurance network restrictions and reimbursement complexities, impacting the delivery of care. These challenges often require strategic solutions such as developing in-house specialty pharmacy services or forging better contract terms with insurance providers.

In conclusion, the specialty pharmaceutical sector is characterized by its focus on high-cost, critical-care medications. Managing these complex therapies demands sophisticated strategies to ensure accessibility, efficacy, and financial sustainability. As the market continues to evolve, healthcare systems must adapt to meet the needs of an increasingly diverse patient population, navigating regulatory changes and market dynamics that influence drug distribution and cost management.

Get Sample PDF Report: https://market.us/report/specialty-pharmaceutical-market/request-sample/

Key Takeaway

• The Specialty Pharmaceutical Market is forecasted to grow to USD 1,532.8 billion by 2033 from USD 68.3 billion in 2023.

• An estimated compound annual growth rate (CAGR) of 36.5% is expected for the market from 2023 to 2033.

• In 2023, oncology held the largest segment share, accounting for over 42% of the specialty pharmaceutical market.

• The Multiple Sclerosis (MS) sector within the market is experiencing substantial growth.

• Market segments for inflammatory conditions continue to be crucial for overall market expansion.

• The Infectious Diseases segment is undergoing changes, spurred by developments during the COVID-19 pandemic.

• The most prevalent method of drug delivery in 2023 was oral, capturing more than 45% of the market.

• Parenteral routes, primarily injectables, also represent a significant portion of the market.

• There is increasing interest in transdermal delivery systems, although they currently make up a smaller segment.

• In 2023, offline distribution channels were predominant, holding over 56% of the market.

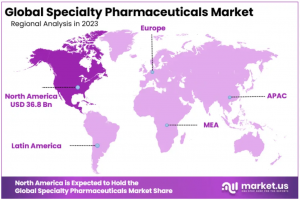

• North America was the leading contributor to the market, with a 54% share, equating to USD 36.8 billion.

• The market is highly concentrated, with the top 10 companies controlling about 60% of the global share.

• Teva Pharmaceutical Industries Ltd. is a major player, holding approximately 40% of the market.

Segmentation Analysis

Oncology and Specialty Pharmaceuticals (2023) In 2023, the oncology sector led the Specialty Pharmaceutical Market with a 42% share. This dominance stems from a global rise in cancer cases and the demand for targeted treatments. Personalized medicine advancements are notably enhancing this segment, focusing on therapies tailored to genetic profiles. Additionally, the Multiple Sclerosis (MS) segment is expanding due to increased disease prevalence and advances in modifying therapies.

Inflammatory and Infectious Disease Segments The market for inflammatory conditions is growing, driven by heightened awareness and new biologics targeting autoimmune and chronic inflammation diseases. Concurrently, the Infectious Diseases segment has evolved post-COVID-19, focusing on developing antivirals and combating antibiotic-resistant bacteria. Investments in this area are surging, reflecting the critical need for effective treatments against persistent infectious threats.

Route of Administration Insights The oral administration route dominated the market in 2023, holding over a 45% share, favored for its simplicity and patient compliance. Conversely, the parenteral segment, including intravenous therapies, is vital for drugs requiring rapid absorption. The transdermal delivery segment is also emerging, benefiting from non-invasive application and continuous medication delivery, supported by advances in patch technologies.

Distribution Channel Trends Offline distribution channels, including physical pharmacies and healthcare facilities, dominated the market with a 56% share in 2023. These channels are preferred for their immediate access and professional consultation necessity. However, the online segment is growing, driven by e-commerce advances and the convenience of home delivery. This growth indicates a shift towards digital integration in healthcare, suggesting future market equilibrium between online and offline channels.

Application

• Oncology

• Multiple sclerosis

• Inflammatory conditions

• Infectious diseases

Route of Administration

• Oral

• Parenteral

• Transdermal

Distribution Channel

• Offline

• Online

The Primary Entities Identified In This Report Are:

• Teva Pharmaceutical Industries Ltd.

• Pfizer Inc.

• AbbVie Inc.

• Amgen Inc.

• Johnson and Johnson

• Bristol-Myers Squibb Company

• Novo Nordisk

• Novartis AG

• Gilead Sciences Inc.

• Sanofi S.A.

Regional Analysis

In 2023, North America led the Specialty Pharmaceutical Market, holding a 54% share worth USD 36.8 billion. This dominance is attributed to the rising incidence of chronic and rare diseases, including cancer and sickle cell disease. The U.S. plays a pivotal role, driven by high cancer rates and the prevalence of genetic disorders like sickle cell anemia, ensuring continued regional supremacy.

The market's strength stems from significant disease prevalence; for instance, the U.S. recorded 2,281,658 new cancer cases in 2020 alone. Sickle cell disease affects approximately one in every 500 African Americans, with around 300,000 infants born with it globally each year. Strategic initiatives, such as the FDA's 2022 orphan drug designation for a new multiple myeloma therapy, further propel market growth.

North America's market dynamics are bolstered by hefty R&D investments, exceeding USD 149.8 billion annually. The region benefits from rapid pharmaceutical industry developments, extensive mergers, and acquisitions. Additionally, strong purchasing power and robust reimbursement policies enhance support for specialty pharmaceuticals, underpinning market expansion.

Meanwhile, the Asia Pacific region is on track for significant growth due to its large population, rising chronic disease rates, and technology adoption. The WHO anticipates nearly 23.6 million cardiovascular-related deaths by 2030, mainly in lower and middle-income countries. This upsurge underscores the increasing demand for specialty pharmaceuticals in Asia Pacific, highlighting a shift towards global market re-balancing.

Buy Directly: https://market.us/purchase-report/?report_id=45468

Emerging Trends in Specialty Pharmaceuticals

• Precision Medicine: Specialty pharmaceuticals are increasingly focusing on precision medicine, where treatments are tailored to individual genetic profiles. This approach is particularly relevant for diseases like cancer and rare genetic disorders, where targeted therapies can lead to better outcomes and fewer side effects.

• Digital Health Integration: The integration of digital health technologies is reshaping specialty pharmaceuticals. Wearable devices and health apps are becoming crucial in monitoring patient health and managing chronic conditions, enabling real-time adjustments to treatment plans.

• Sustainability Initiatives: There is a growing emphasis on sustainability within the pharmaceutical industry. This includes the adoption of green manufacturing processes, sustainable sourcing of raw materials, and the use of biodegradable packaging to reduce environmental impact.

• Decentralized Clinical Trials: The use of decentralized clinical trials (DCTs) is expanding, allowing for broader participation and more diverse data collection without geographical constraints. This trend is facilitated by digital and remote monitoring technologies.

• AI and Big Data: Artificial Intelligence (AI) and big data analytics are playing pivotal roles in drug discovery and patient management. These technologies help predict drug efficacy, optimize clinical trials, and enhance personalized medicine strategies.

Use Cases in Specialty Pharmaceuticals

• Genomic-Based Drug Development: Utilizing genomic data to develop drugs that are specifically effective for individuals based on their genetic makeup. This not only increases the efficacy but also minimizes adverse effects, making treatments more patient-specific.

• Real-Time Health Monitoring: Specialty pharmaceuticals are leveraging wearable technology to monitor vital signs and manage treatment effects in real-time. This technology enables adjustments in therapy in response to immediate health data, improving patient outcomes.

• Biodegradable Drug Delivery Systems: Innovation in drug delivery is focusing on biodegradable materials that reduce environmental impact. For instance, companies are developing implantable devices that deliver medication efficiently and then safely biodegrade within the body.

• Telemedicine for Chronic Diseases: Telemedicine platforms are being integrated with specialty pharmaceutical practices to provide continuous support and management for chronic disease patients, reducing the need for frequent hospital visits and enhancing patient compliance with treatment protocols.

• AI-driven Predictive Analytics: AI algorithms analyze vast amounts of data to predict which drug formulations will be most effective for specific patient groups. This not only accelerates the drug development process but also improves the precision of targeting diseases at the molecular level.

*We offer customized market research reports tailored to meet your specific business needs and requirements.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release